jersey city property tax calculator

Ad Enter Any Address Receive a Comprehensive Property Report. Can any one tell me how to calculate the property tax in jersey city.

Property Tax How To Calculate Local Considerations

Get driving directions to this office.

. GIT REP-1 Nonresident Sellers Tax Declaration. The calculator provides an estimate of your 2022 Property Tax bill which is mailed at the end of May. A towns general tax rate is calculated by dividing the total amount needed to be raised by the total assessed value of all its taxable property.

Your actual bill may include factors specific to your account that may change the total amount owed. Lindsay 152620 102204 0. Jersey City Municipal Government.

New Jerseys real property tax is an ad valorem tax or a tax according to value. Counties in New Jersey collect an average of 189 of a propertys assesed fair market value as property tax per year. RTF-1 EE Affidavit of Consideration for Use by Buyers.

Use this calculator to estimate your NJ property tax bill. The Jersey City sales tax rate is. New Jersey Transfer Tax.

The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000. Search Any Address 2. How to calculate the property tax in Jersey City.

See Results in Minutes. New Jersey State Tax Quick Facts. Box 2025 Jersey City NJ 07303.

For comparison the median home value in New Jersey is 34830000. Enter Your Salary and the Jersey Salary Calculator will automatically produce a salary after tax illustration for you simple. Purchase Price Purchase Price is the only field required.

The minimum combined 2022 sales tax rate for Jersey City New Jersey is. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Unsure Of The Value Of Your Property.

If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact your county or citys. See Property Records Tax Titles Owner Info More. Ad Be Your Own Property Detective.

This is the total of state county and city sales tax rates. City of Jersey City. For comparison the median home value in Ocean County is 29410000.

The Garden State has a lot of things going for it but low taxes are not among its virtues. The New Jersey sales tax rate is currently. For comparison the median home value in New Jersey is.

How to calculate the property tax in Jersey City. - Compare Cities cost of living across 9 different categories - Personal salary calculations can optionally include Home ownership or rental Child care and Taxes with details on state and local sales income property and automobile taxes - Includes the cost of Child Care for toddlers or infants at a day. Left to the county however are appraising property issuing levies making collections enforcing compliance and resolving disagreements.

Follow these simple steps to calculate your salary after tax in Jersey using the Jersey Salary Calculator 2022 which is updated with the 202223 tax tables. The tax rate for The Oakman is calculated based on current variable factors that may change over time which may cause the rate to vary from the amounts listed. The County sales tax rate is.

The standard measure of property value is true value or market value that is what a willing. Timothy Henderson 135113 051503 1 Re. The total amount of property tax to be collected by a town is determined by its county municipal and school budget costs.

Online Inquiry Payment. Total Tax Savings Years 18-20. Select Advanced and enter your age to alter age.

General Property Tax Information. An individual taxpayers property taxes are calculated by multiplying the. The yearly and Change amounts factor in the impact of Provincial and City budget adjustments and your year-to-year assessment change.

201 547 5132 Phone 201 547 4949 Fax The City of Jersey City Tax Assessors Office is located in Jersey City New Jersey. New Jersey has one of the highest average property tax rates in the country with only states levying higher property. Can any one tell me how to calculate the property tax in jersey city.

The property tax rate is 4548 for each 1000 of assessed value. All real property is assessed according to the same standard of value except for qualified agricultural or horticultural land. Purchase Price Purchase Price is the only field required.

The tax rates for the listed municipalities are the rates applicable in 2016 and will be. Say on a new home built valued at 220000. Jersey City New Jersey 07302.

Real estate evaluations are undertaken by the county. The average effective property tax rate in New Jersey is 242 compared to. Account Number Block Lot Qualifier Property Location 18 14502 00011 20 HUDSON ST.

Jersey City Hall 280 Grove Street Room 116. Useful Transfer Tax Links. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

City of Jersey City Tax Assessor. How to calculate the property tax in Jersey City. RTF-1 Affidavit of Consideration for Use by Sellers.

Below 100 means cheaper than the. The median property tax on a 29410000 house is 308805 in the United. Find All The Record Information You Need Here.

Say on a new home built valued at 220000. 242 average effective rate. Search For Title Tax Pre-Foreclosure Info Today.

201 547 5132 Phone 201 547 4949 Fax The City of Jersey City Tax Assessors Office is located in Jersey City New Jersey. GIT REP-2 Nonresident Sellers Tax. Jersey City establishes tax levies all within the states statutory rules.

1050 cents per gallon of regular gasoline 1350 cents per gallon of diesel. Our Premium Calculator Includes. Did South Dakota v.

Property Tax Calculator - Estimate Any Homes Property Tax. Taxes in New Jersey. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Ocean County Tax. Lindsay 152620 102204 0.

Township Of Nutley New Jersey Property Tax Calculator

Riverside County Ca Property Tax Calculator Smartasset

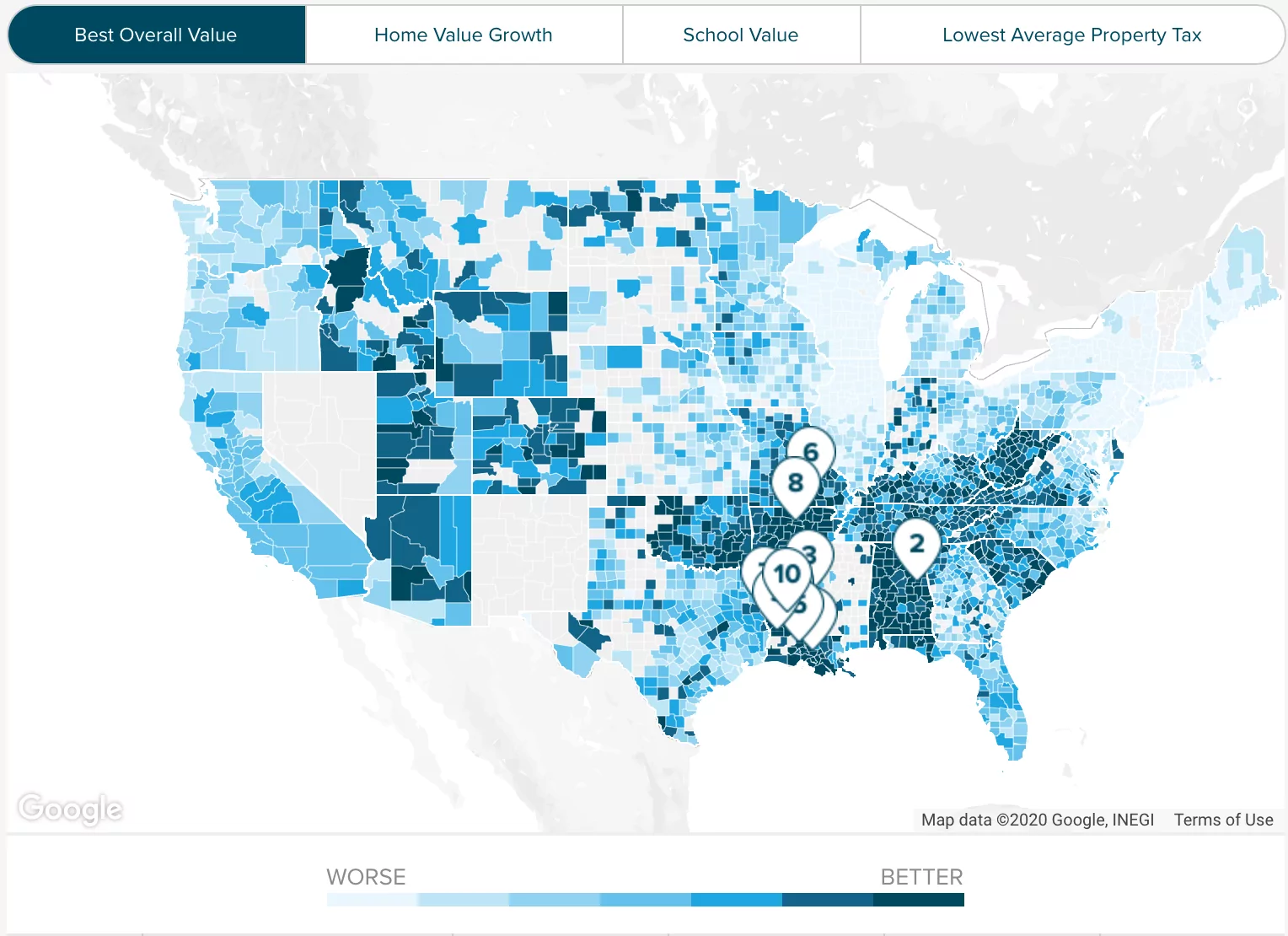

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Property Tax Comparison By State For Cross State Businesses

New York Property Tax Calculator 2020 Empire Center For Public Policy

Property Tax Bill Gone Missing Here S How To Get A New One Department Of Revenue City Of Philadelphia

Jersey City S Property Tax Rate Finalized At 1 48 Jersey Digs

The Outstanding Printable Home Inspection Report Template Elegant 2018 Home Intended For Property Management Inspectio Report Template Best Templates Templates

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

New York Property Tax Calculator Smartasset

14 Self Storage Marketing Ideas Marketing Ideas Storage And Cube Storage

U S Property Taxes Comparing Residential And Commercial Rates Across States

Pin By Tu On Buildings House Exterior Home Design Software Free Home Design Software

Tax Bill Breakdown City Of Woodbury

5 Reasons To Sell Before The Selling Season Picks Up By Jeff Kram Things To Sell Austin Real Estate Selling Your House